Advertisement

-

Published Date

April 20, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

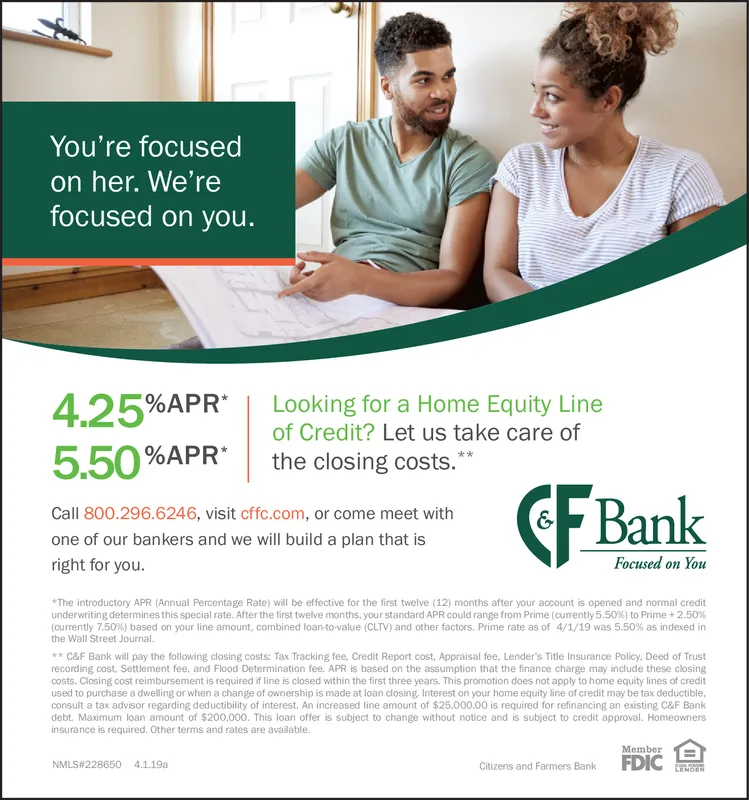

You're focused on her. We're focused on you. 4 2 %APR* | Looking for a Home Equity Line of Credit? Let us take care of of 5.50%APR'! the closing costs." Call 800.296.6246, visit cffc.com, or come meet with one of our bankers and we will build a plan that is Bank 6 right for you. Focused on You The introductory APR (Annual Percentage Rate) will be effective for the first twelve (12) months after your account is opened and normal credit underwriting determines this special rate. After the first twelve months, your standard APR could range from Prime (currently 5.50%) to Prime + 2.5 % (currently 7.50%) based on your line amount, combined loan-to-value (CLTV) and other factors. Prime rate as of 4/1/19 was 5.50% as indexed i the Wall Street Journal **C&F Bank will pay the following closing costs: Tax Tracking fee, Credit Report cost, Appraisal fee, Lender's Title Insurance Policy, Deed of Trust recording oost. Settlement fee, and Flood Determination fee. APR is based on the assumption that the finanoe charge may include these closing oosts. Closing cost reimbursement is required if line is closed within the first three years. This promotion does not apply to home equity lines of credit used to purchase a dwelling or when a change of ownership is made at loan closing. Interest on your home equity line of credit may be tax deductible, consult a tax advisor regarding deductibility of interest. An increased line amount of $25,000.00 is required for refinancing an exsting C&F Bank debt. Maximum loan amount of $200,000. This loan offer is subject to change without notice and is subject to credit approval. Homeowners insurance is required. Other terms and rates are avadable. FDIC NMLS#228650 4.1.19a Citizens and Farmers Bank