Advertisement

-

Published Date

August 17, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

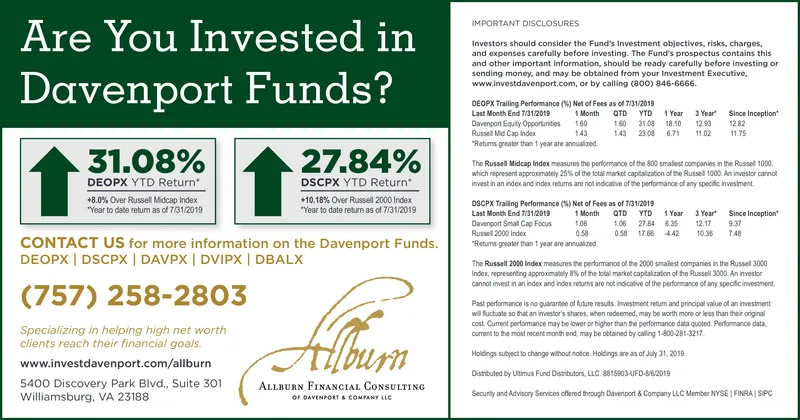

Are You Invested in IMPORTANT DISCLOSURES Investors should consider the Fund's Investment objectives, risks, charges and expenses carefully before investing. The Fund's prospectus contains this and other important information, should be ready carefully before investing or sending money, and may be obtained from your Investment Executive, Davenport Funds? www.investdavenport.com, or by calling (800) 846-6666 DEOPX Trailing Performance (%) Net of Fees as of 7/31/2019 Last Month End 7/31/2019 3 Year 1293 11.02 Since Inception 12.82 1 Month QTD 160 31.08 143 23.08 YTD 1 Year Davenport Equity Opportunities Russell Mid Cap Index 160 143 18.10 6.71 1175 "Retums greater than t year are annualized 31.08% DEOPX YTD Return 27.84% The Russell Midcap lIndex measures the performance of the 800 smalest companies in the Russel 1000, which represent approximately 25% of the total market capitalization of the Russell 1000 An investor cannot invest in an index and index returns are not indcative of the performance of any specific investment DSCPX YTD Return +8.0% Over Russell Midcap Index Year to date retum as of 7/31/2019 +10.18% Over Russell 2000 Index "Year to date return as of 7/31/2019 DSCPX Trailing Performance (%) Net of Fees as of 731/2019 Since Inception 9.37 7.48 Last Month End 7/31/2019 1 Month QTD 106 058 YTD 1Year 3 Year Davenport Smal Cap Focus Russell 2000 Index 106 0.58 27 84 6.35 17.66 442 12.17 10.36 CONTACT US for more information on the Davenport Funds. DEOPX DSCPX DAVPX | DVIPX | DBALX "Retums greater than 1 year are annualized The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russel 3000 Index, nepresenting approximately 8% of the total market capitalization of the Russell 3000. An investor cannot invest in an index and index retuns are not indicative of the performance of any specific investment 258-2803 (757) Past performance is no guarantee of future results. Investment retum and principal value of an investment will fuctuate so that an investor's shares, when redeemed, may be worth mone or less than their original cost Current performance may be lower or higher than the performance data quoted. Performance data curent to the most recent month end, may be obtained by calling 1-800-281-3217 lburn Specializing in helping high net worth clients reach their financial goals. Holdings subject to change without notce. Holdings are as of July 31, 2019 www.investdavenport.com/allburn Disrbuted by Utimus Fund Distributors, LLC. 8815903-UFD-S82019 5400 Discovery Park Blvd., Suite 301 Williamsburg, VA 23188 ALLBURN FINANCIAL CONSULTING Security and Advisory Services ofered through Davenport &Company LLC Member NYSE FINRA SPC OF DAVENPORT&COMPANY LLC Are You Invested in IMPORTANT DISCLOSURES Investors should consider the Fund's Investment objectives, risks, charges and expenses carefully before investing. The Fund's prospectus contains this and other important information, should be ready carefully before investing or sending money, and may be obtained from your Investment Executive, Davenport Funds? www.investdavenport.com, or by calling (800) 846-6666 DEOPX Trailing Performance (%) Net of Fees as of 7/31/2019 Last Month End 7/31/2019 3 Year 1293 11.02 Since Inception 12.82 1 Month QTD 160 31.08 143 23.08 YTD 1 Year Davenport Equity Opportunities Russell Mid Cap Index 160 143 18.10 6.71 1175 "Retums greater than t year are annualized 31.08% DEOPX YTD Return 27.84% The Russell Midcap lIndex measures the performance of the 800 smalest companies in the Russel 1000, which represent approximately 25% of the total market capitalization of the Russell 1000 An investor cannot invest in an index and index returns are not indcative of the performance of any specific investment DSCPX YTD Return +8.0% Over Russell Midcap Index Year to date retum as of 7/31/2019 +10.18% Over Russell 2000 Index "Year to date return as of 7/31/2019 DSCPX Trailing Performance (%) Net of Fees as of 731/2019 Since Inception 9.37 7.48 Last Month End 7/31/2019 1 Month QTD 106 058 YTD 1Year 3 Year Davenport Smal Cap Focus Russell 2000 Index 106 0.58 27 84 6.35 17.66 442 12.17 10.36 CONTACT US for more information on the Davenport Funds. DEOPX DSCPX DAVPX | DVIPX | DBALX "Retums greater than 1 year are annualized The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russel 3000 Index, nepresenting approximately 8% of the total market capitalization of the Russell 3000. An investor cannot invest in an index and index retuns are not indicative of the performance of any specific investment 258-2803 (757) Past performance is no guarantee of future results. Investment retum and principal value of an investment will fuctuate so that an investor's shares, when redeemed, may be worth mone or less than their original cost Current performance may be lower or higher than the performance data quoted. Performance data curent to the most recent month end, may be obtained by calling 1-800-281-3217 lburn Specializing in helping high net worth clients reach their financial goals. Holdings subject to change without notce. Holdings are as of July 31, 2019 www.investdavenport.com/allburn Disrbuted by Utimus Fund Distributors, LLC. 8815903-UFD-S82019 5400 Discovery Park Blvd., Suite 301 Williamsburg, VA 23188 ALLBURN FINANCIAL CONSULTING Security and Advisory Services ofered through Davenport &Company LLC Member NYSE FINRA SPC OF DAVENPORT&COMPANY LLC