Advertisement

-

Published Date

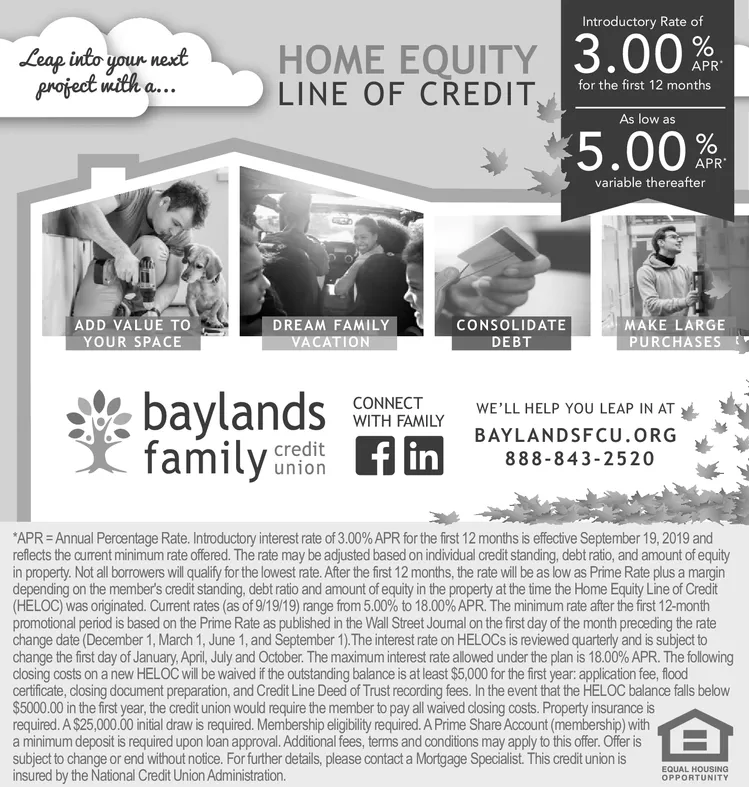

October 17, 2019This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

Introductory Rate of HOME EQUITY 3.00 LINE OF CREDIT Leap into your next project mith a... APR for the first 12 months As low as 5.00 APR variable thereafter ADD VALUE TO YOUR SPACE CONSOLIDATE DEBT MAKE LARGE PURCHASES DREAM FAMILY VACATION baylands CONNECT WE'LL HELP YOU LEAP IN AT WITH FAMILY BAYLANDSFCU.ORG f in familyde 888-843-2520 union APR Annual Peroentage Rate. Introductory interest rate of 3.00% APR for the first 12 months is effective September 19, 2019 and reflects the current minimum rate offered. The rate may be adjusted based on individual credit standing, debt ratio, and amount of equity in property. Not all borrowers will qualify for the lowest rate. After the first 12 months, the rate will be as low as Prime Rate plus a margin depending on the member's credit standing, debt ratio and amount of equity in the property at the time the Home Equity Line of Credit (HELOC) was originated. Curent rates (as of 9/19/19) range from 5.00% to 18.00 % APR. The minimum rate after the first 12-month promotional period is based on the Prime Rate as published in the Wall Street Joumal on the first day of the month preceding the rate change date (December 1, March 1, June 1, and September 1).The interest rate on HELOCS is reviewed quarterly and is subject to change the first day of January, Apri, July and October. The maximum interest rate allowed under the plan is 18.00% APR. The following dlosing costs on a new HELOC will be waived if the outstanding balance is at least $5,000 for the first year application fee, flood certificate, dlosing document preparation, and Credit Line Deed of Trust recording fees. In the event that the HELOC balance falls below $5000.00 in the first year, the credit union would require the member to pay all waived closing costs. Property insurance is required. A $25,000.00 initial draw is required. Membership eligibility required. A Prime Share Account (membership) with a minimum deposit is required upon loan approval. Additional fees, terms and conditions may apply to this offer. Offer is subject to change or end without notice. For further details, please contact a Mortgage Specialist. This credit union is insured by the National Credit Union Administration. EQUAL HOUSING OPPORTUNITY Introductory Rate of HOME EQUITY 3.00 LINE OF CREDIT Leap into your next project mith a... APR for the first 12 months As low as 5.00 APR variable thereafter ADD VALUE TO YOUR SPACE CONSOLIDATE DEBT MAKE LARGE PURCHASES DREAM FAMILY VACATION baylands CONNECT WE'LL HELP YOU LEAP IN AT WITH FAMILY BAYLANDSFCU.ORG f in familyde 888-843-2520 union APR Annual Peroentage Rate. Introductory interest rate of 3.00% APR for the first 12 months is effective September 19, 2019 and reflects the current minimum rate offered. The rate may be adjusted based on individual credit standing, debt ratio, and amount of equity in property. Not all borrowers will qualify for the lowest rate. After the first 12 months, the rate will be as low as Prime Rate plus a margin depending on the member's credit standing, debt ratio and amount of equity in the property at the time the Home Equity Line of Credit (HELOC) was originated. Curent rates (as of 9/19/19) range from 5.00% to 18.00 % APR. The minimum rate after the first 12-month promotional period is based on the Prime Rate as published in the Wall Street Joumal on the first day of the month preceding the rate change date (December 1, March 1, June 1, and September 1).The interest rate on HELOCS is reviewed quarterly and is subject to change the first day of January, Apri, July and October. The maximum interest rate allowed under the plan is 18.00% APR. The following dlosing costs on a new HELOC will be waived if the outstanding balance is at least $5,000 for the first year application fee, flood certificate, dlosing document preparation, and Credit Line Deed of Trust recording fees. In the event that the HELOC balance falls below $5000.00 in the first year, the credit union would require the member to pay all waived closing costs. Property insurance is required. A $25,000.00 initial draw is required. Membership eligibility required. A Prime Share Account (membership) with a minimum deposit is required upon loan approval. Additional fees, terms and conditions may apply to this offer. Offer is subject to change or end without notice. For further details, please contact a Mortgage Specialist. This credit union is insured by the National Credit Union Administration. EQUAL HOUSING OPPORTUNITY